Strategic Partner Services

Go through the Process

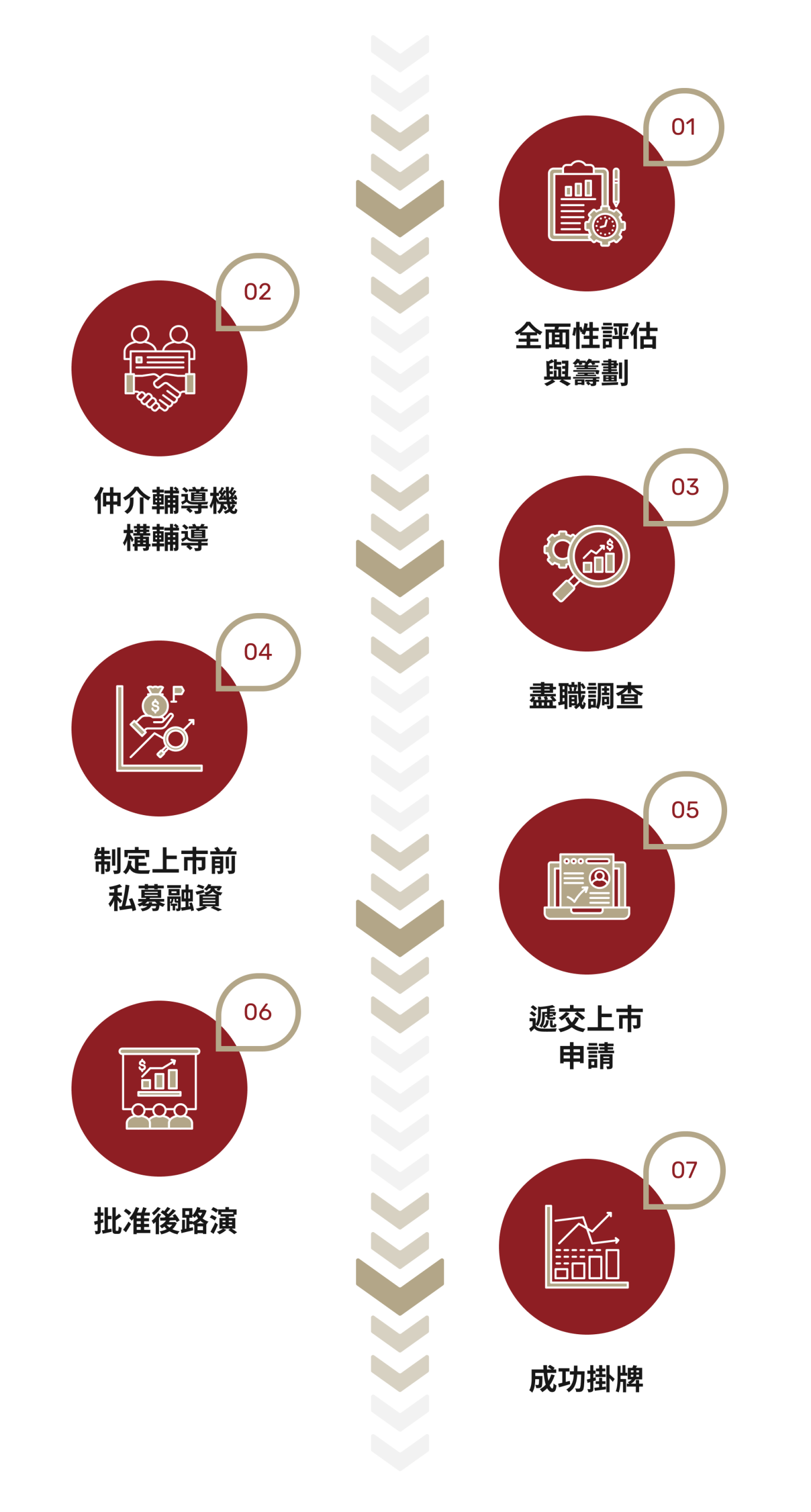

IPO Guidance Process

-

(1) Comprehensive Evaluation and Planning:

Preliminary diagnosis of whether the company meets IPO requirements / Assessment of company value and market potential / Development of IPO timeline and capital structure plan

-

(2) Guidance by Intermediary Institutions

Underwriters: Responsible for stock issuance and sales strategy formulation / Legal team: Ensuring regulatory compliance and drafting legal documents / Accounting and auditing firms: Conducting financial review and preparing statements

-

(3) Due Diligence

Financial due diligence: Reviewing financial statements and business operations / Legal due diligence: Verifying company compliance and potential legal risks / Operational due diligence: Assessing market competitiveness and future growth potential

-

(4) Establishing Pre-IPO Private Financing

Adjusting company financial capital structure / Engaging potential investors and conducting fundraising presentations / Negotiating investment terms and signing investment agreements

-

(5) Submission of IPO Application

Prospectus / Various compliance documents

-

(6) Post-Approval Roadshow

PDIE (Pre-Deal Investor Education) / Bookbuilding and Pricing / Investor Meetings

-

(7) Successful Listing

Price stabilization mechanism / Lock-up period / Investor relations management

We Help Grow Your Business

Our Advantages

DY Group Holdings Limited is not only an investor but also a strategic partner for enterprises’ cross-border development and international listing. Compared to other Asian investment institutions, we have the following four unique advantages:

(1) Top Strategic Partners x Global Capital Markets:

Support from strategic partner resources / Alignment with top international investment banking standards / Connection to global capital markets

(2) One-Stop Fundraising x Investment and Listing Guidance:

Cooperation with international private equity funds / Pre-IPO planning and guidance / Introduction of strategic partner resources

(3) Experts in US Market M&A and IPO:

IPO application and compliance guidance / Corporate financial advisory / Post-IPO market value management

(4) Dual-Track Guidance: Capital on the Left x Strategy on the Right:

Professional market value management and investor relations / Market share and financing capability / Building leading brand status after listing

Guide You Through the Process

Strategic Partners

World-Class Strategic Partners — Unlocking Infinite Possibilities for Outstanding Enterprises

Exceptional strategic partners play a pivotal role in helping enterprises access international capital markets.DY Group Holdings Limited has formally established strategic partnerships with world-leading financial institutions such as Tiger Brokers (U.S.) and Nomura Securities (Japan), working together to provide companies with the most professional and comprehensive IPO guidance and international capital deployment. We are not only a bridge to Wall Street, but also the strongest support for enterprises aiming to integrate global resources and enhance international competitiveness.

Choosing DY Group Holdings Limited means standing on the shoulders of giants and attracting global capital. Let us move forward hand in hand and lead your enterprise onto the world stage.

Through collaboration with strategic partners, we ensure enterprises gain:

- Pass the most compliant qualification reviews

- Meet the optimal private placement funding conditions

- Achieve the best market valuation

- Gain support from long-term investors

| Typical Asian VC Firms | DingYing Group | |

| ♦ Strategic Partnerships | Mainly connected with regional investors in Asia; limited access to U.S. markets and weaker investor relations after listing | Cooperates with top international investment banks, brokers, and VC funds; ensures IPO qualification and strong post-listing valuation |

| ♦ Fundraising Model | Most VCs provide early-stage funding only, lacking post-IPO and market value management services | Collaborates with international PE funds, acts as financial advisor, and provides capital needed for IPO |

| ♦ IPO & Global Expansion | Focuses on local markets with limited cross-border IPO experience | Specializes in U.S. capital markets IPO advisory, provides complete listing roadmap and post-IPO operational support |

| ♦ Long-Term Value Creation | Mostly short-term investments, exits after pre-IPO, with limited long-term capital and enterprise support |

Comprehensive support from early advisory, financial planning, PE fundraising, pre-IPO to listing and M&A, ensuring long-term development in global markets |

Global Investment Platform × U.S. IPO Specialist — Tiger Brokers USA

Tiger Brokers USA

Advantages:

Tiger Brokers USA, a globally recognized brokerage firm listed on Nasdaq, possesses deep expertise in the U.S. capital markets. Acting as a vital bridge between Asian enterprises and Wall Street, Tiger maintains long-term strategic partnerships with institutional investors, sovereign wealth funds, and private equity firms. With its keen insight into international capital market trends, Tiger empowers companies to maximize their advantages in cross-border fundraising, IPO planning, and investor relations management.

Cooperation Model with DY Group Holdings Limited:

DY Group Holdings Limited is the official partner of Tiger Brokers Asia, working together to create the best path for enterprises to enter the U.S. capital market.

Global Investor Engagement and Pre-IPO Advisory:

Leveraging Tiger Brokers’ extensive investor network, DY Group Holdings Limited can help companies gain strong international investor interest before listing, enhancing market awareness and corporate value.

U.S. IPO Underwriting and Capital Raising:

As an expert in U.S. listings, Tiger Brokers provides comprehensive support from IPO planning and roadshow arrangements to capital raising, ensuring a smooth entry for companies onto Wall Street.

Post-Listing Support and Long-Term Management:

Listing is only the first step. Tiger Brokers and DY Group Holdings Limited will jointly assist companies in maintaining investor relations, enhancing market confidence, and continuously optimizing their international capital strategy to support sustained value growth in the U.S. stock market.

Global Legal Advisor × International Regulatory Expert

Robinson+Cole, United States

Advantages:

Robinson+Cole, a well-known international law firm in the United States with over 175 years of history, is ranked among the top 200 law firms in the country by The American Lawyer magazine. It possesses deep expertise in securities law, cross-border mergers and acquisitions, corporate compliance, and capital markets regulation. Their team provides comprehensive legal support to companies, ranging from IPO legal due diligence to post-listing compliance management, assisting businesses in effectively meeting U.S. SEC regulatory requirements and ensuring compliance and security in international business expansion.

Cooperation Model with DY Group Holdings Limited:

DY Group Holdings Limited has established a strategic partnership with Robinson+Cole to provide global legal support for enterprises, ensuring their stable development in the U.S. capital markets.

SEC Regulations and IPO Legal Compliance Review:

Robinson+Cole has deep expertise in the regulatory requirements of the U.S. Securities and Exchange Commission (SEC), offering professional consultation on IPO application document preparation, regulatory risk assessment, and ensuring full compliance throughout the listing process.

Cross-Border M&A and International Legal Framework:

Assisting companies in designing optimal international structures to ensure that equity structures, financial planning, and M&A transactions comply with U.S. and global regulations, reducing legal risks and optimizing capital allocation before and after listing.

Post-Listing Regulatory Support and Corporate Compliance Management:

DY Group Holdings Limited, in partnership with Nomura Securities, provides full advisory services throughout the cross-border M&A process—from target evaluation and negotiation strategies to transaction integration—helping companies effectively manage risks and ensure smooth deal completion.

Post-Listing Support and Long-Term Management:

After listing, Robinson+Cole will continue to assist companies with key legal matters such as U.S. capital market regulations, corporate governance, and information disclosure, ensuring ongoing compliance in global markets and strengthening trust with international investors.

To Get the Best, You Need to Work With the Best

Our Partners