DYGHoldings Hosts the “U.S. Stock 24-Hour Trading Forum” — Building a Knowledge Bridge for Asian Companies to Understand the U.S. Capital Market

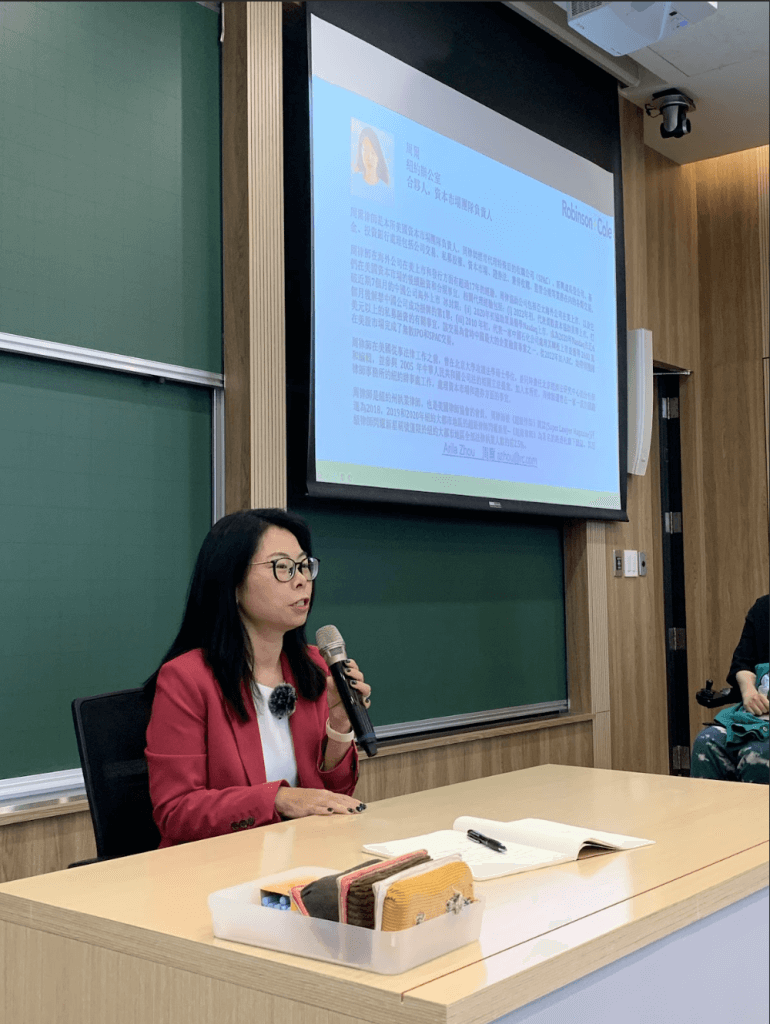

On April 18, 2025, the “U.S. Stock 24-Hour Trading Forum” hosted by DYGHoldings Management Co., Ltd. was grandly held in Taipei. The forum specially invited Partner and Attorney Er Zhou from the renowned U.S. law firm Robinson & Cole LLP to provide an in-depth analysis of the practical applications and latest developments of mainstream tools such as SPAC, IPO, and ADR, focusing on the diversified fundraising methods and regulatory framework of the U.S. capital market.

Robinson & Cole is an important strategic partner of DYGHoldings, possessing extensive experience in cross-border regulatory consulting and capital market operations. This forum, themed “SEC Regulations and Practical Explanation of U.S. Fundraising Methods,” focuses on the regulatory knowledge and practical judgment skills Asian companies need when expanding into the U.S. stock market, assisting companies in taking the first step toward entering international markets.

Key topics covered in this lecture include:

• Latest SEC compliance requirements and audit procedures for SPAC, IPO, and ADR

• Fundraising strategies and industry applicability analysis in the U.S. capital market

• Common fundraising structure designs and legal risk control for Asian companies

• Investor relations and compliance maintenance recommendations after international listing

• Practical sharing of SPAC cases: breakdown of the process from preparation to successful listing

Attorney Er Zhou holds a New York State Bar license and has long been involved in SPAC listings, fund establishment, and cross-border transaction cases, providing legal advisory services to numerous financial institutions, venture capital, and growth enterprises. The forum attracted many startups, family businesses, and financial professionals, receiving enthusiastic responses.

DYGHoldings pointed out that this forum aims to respond to the increasing attention of Asian companies on topics such as “going public in the U.S.,” “cross-border fundraising,” and “regulatory compliance.” As the Taiwan headquarters of Dingying Group, DYGHoldings is actively implementing the group’s vision of “becoming Asia’s No.1 brand assisting companies to list in the U.S.,” continuously providing cross-market strategic planning and international services through strategic cooperation with top institutions in the U.S., Japan, and beyond. The capital market is the starting point for companies going global.

DYGHoldings will continue to hold forums, lectures, and project consultations, working with quality partners to build a bridge between Asian enterprises and international capital, helping companies’ value to be seen by the world and their potential recognized globally.