DYGHoldings Hosts the “U.S. Stock 24-Hour Trading Forum” — CPA Zhou Zhaoxi Analyzes Key Factors of International IPO from a Financial Perspective

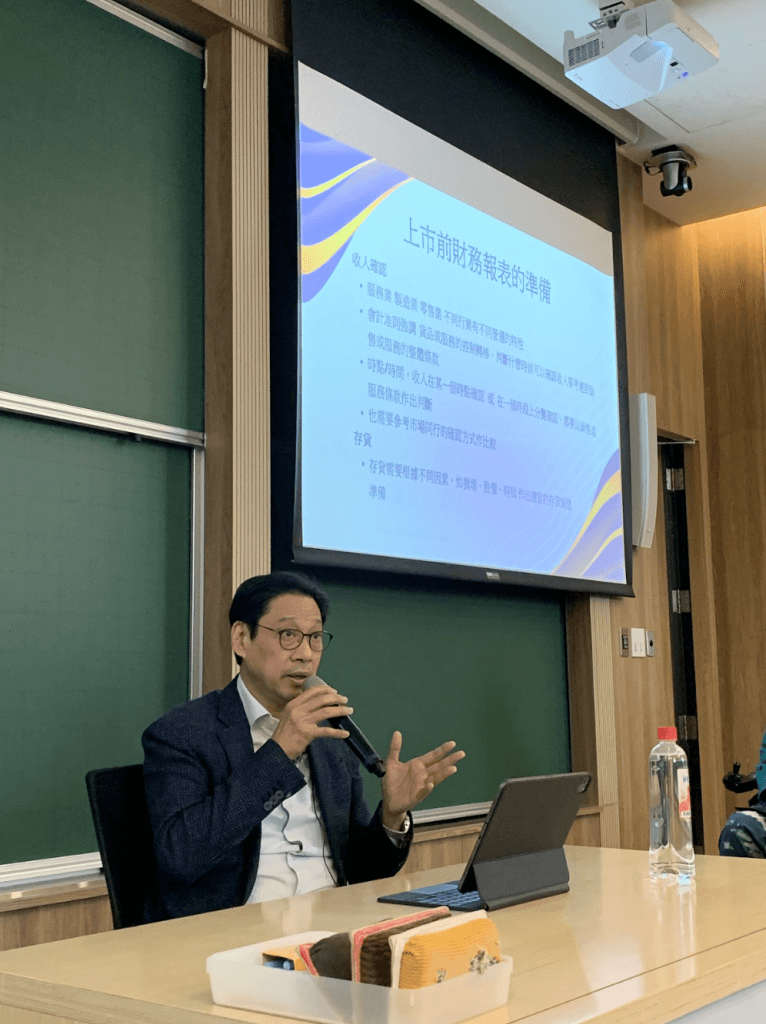

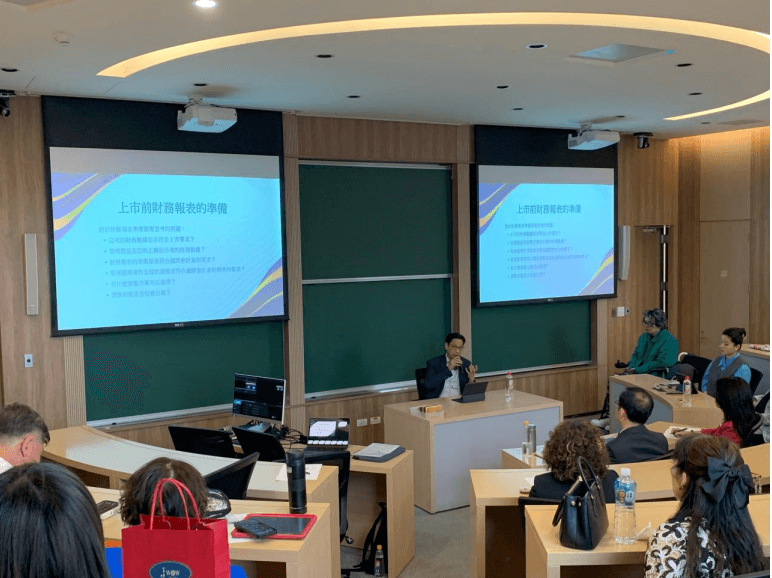

On April 18, 2025, the “U.S. Stock 24-Hour Trading Forum” hosted by DYGHoldings Management Co., Ltd. was grandly held in Taipei. The forum specially invited CPA Zhou Zhaoxi, who has extensive international experience, as the keynote speaker. From the professional perspective of a CPA, he deeply analyzed the financial structure, compliance preparation, and report quality that companies should focus on when entering overseas capital markets.

CPA Zhou Zhaoxi previously served as a partner at EY (Ernst & Young) and PwC (PricewaterhouseCoopers), two of the Big Four international accounting firms. He holds CPA licenses in Hong Kong and Australia and has collaborated with multiple international investment banks and private equity funds to successfully list over 20 companies on markets including the Hong Kong Main Board, Growth Enterprise Market, and NASDAQ in the U.S. Leveraging his profound audit experience and expertise in cross-border financial planning, CPA Zhou provided valuable insights on the critical financial aspects often overlooked by companies in the IPO process during this forum.

The core content of the forum includes:

•Common issues and recommendations in preparing financial statements before initiating an overseas IPO

•Analysis of differences between International Financial Reporting Standards (IFRS / US GAAP) and local regulations

•The importance of financial transparency, internal controls, and governance structures during the listing process

•Case studies of successful IPOs: the role of the finance team throughout the process

•Post-IPO continuous disclosure obligations, consistency in accounting policies, and internal audit and control topics

DYGHoldings pointed out that many companies underestimate the time and complexity required to prepare financial structures and historical reports when entering overseas markets. This forum aims to leverage firsthand experience from practitioners to remind companies to proactively prepare for audit readiness and capital market disclosure requirements, thereby reducing potential risks and successfully achieving international IPO goals.

As the strategic base of Dingying Group in Taiwan, DYGHoldings continues to uphold the vision of being “Asia’s No.1 Brand to Assist Companies Going Public in the U.S.” Through hosting a series of lectures and cooperating with international strategic partners, it has built a comprehensive cross-border IPO support platform.

From early-stage financial planning and fundraising strategies to post-IPO compliance consulting, DYGHoldings is committed to being the most trusted partner for companies on their path to internationalization.

Financial transparency is the cornerstone for companies to go global; professional guidance is the guarantee for companies to succeed.

DYGHoldings will continue to collaborate with experts in international accounting, legal, and investment banking fields to help Asian companies shine in global capital markets.