Yangkang Asset Hosts the “U.S. Stock 24-Hour Trading Forum”

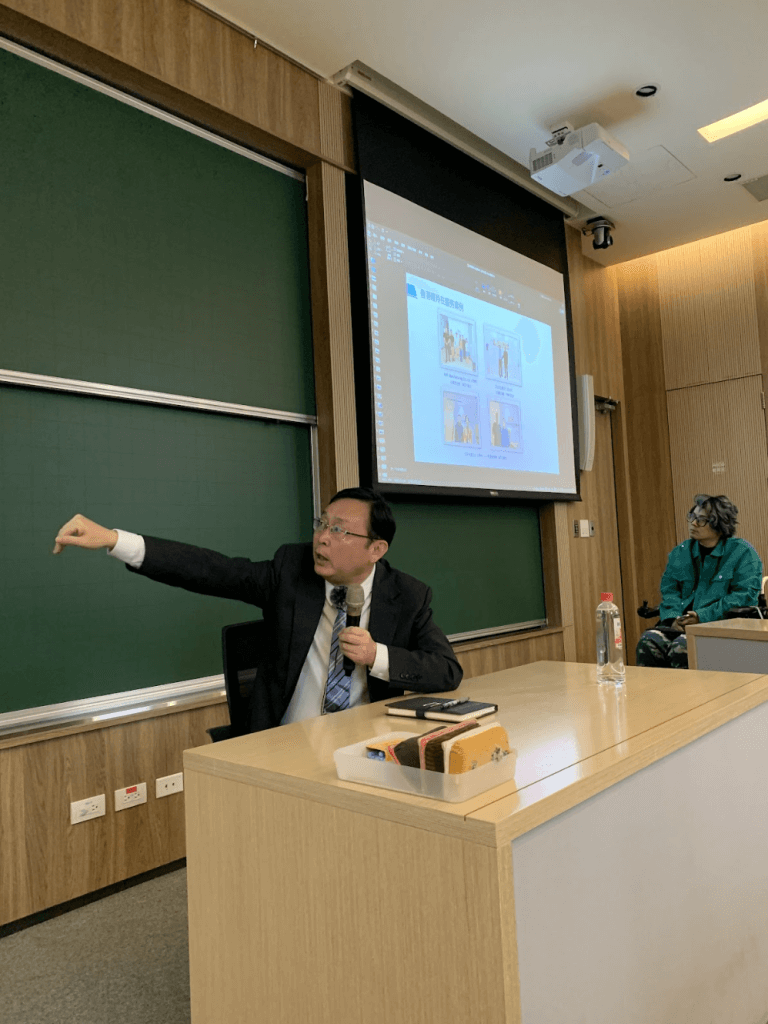

Chairman Qu Hao Shares Firsthand Experience and Key Strategies on U.S. Stock Listings

On April 18, 2025, the “U.S. Stock 24-Hour Trading Forum” hosted by Yangkang Asset Management Co., Ltd. was grandly held in Taipei. Qu Hao, Chairman and CEO of Hong Kong Gazelle Ltd., was invited as the speaker with the theme “Successful Cases and Practical Sharing of Overseas Company Listings.”

Chairman Qu has led many Asian companies to successfully enter the U.S. capital market, especially with practical experience in NASDAQ and the OTC Market (over-the-counter market). His experience covers everything from early financial and organizational structuring, close cooperation with investment banks, law firms, and accounting firms, to process control for official listing. Based on his multiple hands-on experiences, Chairman Qu shared detailed insights into common challenges, key turning points, and strategies encountered during the listing preparation process.

The seminar’s core topics included:

• The transformation journey from startup companies to international capital markets

• Strategic choices under different U.S. listing mechanisms (especially NASDAQ and OTC Market)

• The historical role and evolution of the OTCBB (Over-the-Counter Bulletin Board)

• Financial, regulatory, and internal control aspects Asian companies must pay special attention to when listing in the U.S.

• Practical advice on continuous disclosure and investor relations management post-listing

Chairman Qu emphasized that although the U.S. OTC market has lower entry barriers, it also has high requirements for corporate credibility and financial transparency. Companies that leverage these market platforms can not only quickly connect with global capital but also accumulate strength and experience for future uplisting to main markets. He also pointed out that OTCBB played a vital role in early SME internationalization, and with the evolution of OTCQX, OTCQB, and other systems, overseas companies now have more compliant options.

Yangkang Asset stated that inviting Chairman Qu to share frontline experiences aims to help Taiwanese and Asian companies more pragmatically understand the critical steps on the path to U.S. listing, avoiding misjudgments and missed opportunities. Yangkang will continue to collaborate with experienced strategic partners to promote quality Asian companies to expand overseas and step onto the international stage.